3 5: Use Journal Entries to Record Transactions and Post to T-Accounts Business LibreTexts

Content

- AccountingTools

- Using Accounting Software for Tracking Journal Entries

- You get paid by a customer for an invoice

- Formatting When Recording Journal Entries

- What Is a Journal Entry in Accounting?

- Use of Goods in Business:

- What Does Post Journal Entries Mean?

- Top 10 Accounting Professional Bodies In The World In 2023

When a transaction is made, a bookkeeper records it as a journal entry. If the expense or income affects one or more business accounts, the journal entry will detail that as well. It’s journal entry No. 1, the account number is included after the account name, and the office supplies account has been debited and the cash account credited. Transfer the debit and credit amounts from your journal to your ledger account.

- The written down value method is a tool to evaluate the depreciation in a company’s fixed asset to determine the correct valuation of the asset’s value.

- On January 3, there was a debit balance of $20,000 in the Cash

account. - The journal entry can consist of several recordings, each of which is either a debit

or a credit. - The matching principle establishes guidelines for the reporting of expenses.

- You’ve identified the accounts that will be involved in your journal entry, as well as the type of accounts they are.

- Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent.

- If you’d like to learn more about other small business accounting applications, be sure to check out our small business accounting software reviews.

It is a simple running total of cash inflows and cash outflows. A Journal is a book in which all the transactions of a business are recorded for the first time. The process of recording transactions in the journal is called journalising. You have been exposed to posting in accounting the concepts of recording and journalizing transactions previously, but this explains the rest of the accounting process. The accounting cycle is the repetitive set of steps that must occur in every business every period in order to meet reporting requirements.

AccountingTools

Along with the above perks, posting entries to the general ledger helps you catch accounting mistakes in your records. Catching mistakes early on helps you steer clear of bigger problems down the road, like inaccurate financial reports and tax filings. When posting entries to the ledger, move each journal entry into an individual account. After you record transactions in your journal, it’s time to transfer them to your general ledger. To keep your books accurate, post every transaction from your journal to your general ledger. As a business owner, you juggle a number of tasks, including accounting.

Often accountants omit these explanations because each item can be traced back to the general journal for the explanation. The following are examples of Ledger cards for the some of the accounts from the same company shown in T-accounts above (see how you get the same balance under either approach). When we introduced debits and credits, you learned about the

usefulness of T-accounts as a graphic representation of any account

in the general ledger.

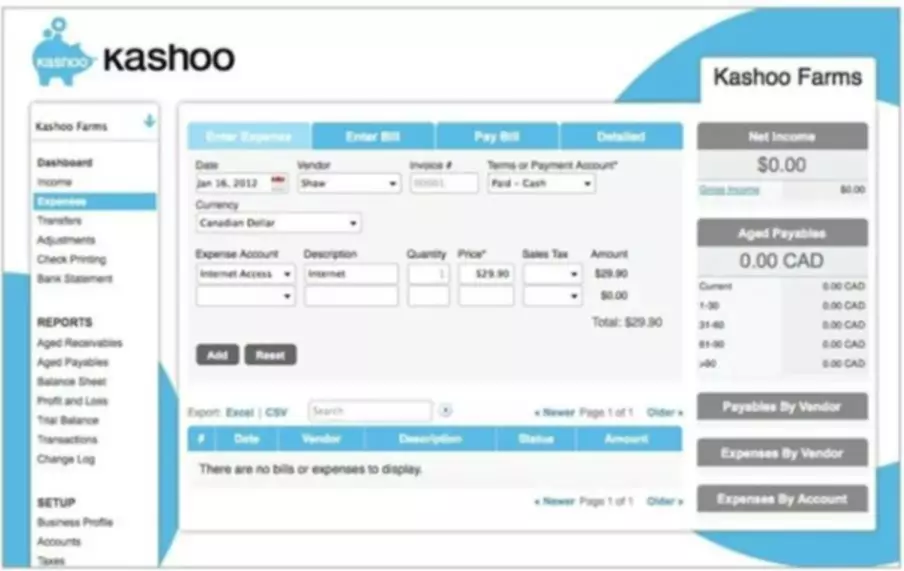

Using Accounting Software for Tracking Journal Entries

Accountants and bookkeepers often use T-accounts as a visual aid to see the effect of a transaction or journal entry on the two (or more) accounts involved. Journal posting is the next step to a journal entry, it precedes balancing the ledger. One of the main difference between journal entry and journal posting is “timing”, the journal entry is the next step to preparing vouchers, it immediately precedes journal posting. If you fall into the second category, let Bench take bookkeeping off your hands for good. If you use accrual accounting, you’ll need to make adjusting entries to your journals every month.

Thus, posting only applies to these larger-volume situations. For low-volume transaction situations, entries are made directly into the general ledger, so there are no subledgers and therefore no need for posting. The accounting cycle involves updating, changing and verifying financial transactions during the course of business operations. Recording and posting in accounting are part of this cycle, and though they sound similar, their functions are completely different.

You get paid by a customer for an invoice

A business journal is used to record business transactions as they occur. Purchasing process involves a number of steps starting from placing an order and ending with the delivery of goods. Apart from the cost incurred in purchasing the goods, any additional expenses like Carriage, Import Duty, etc is also paid.

To reverse a posted journal, modify the reversal fields in on a posted

journal or use the automatic reversal functionality. The first step in the accounting cycle starts by identifying events and analyzed them to see how they affect the accounting equation. After events are identified, they can be record in the general journal with a journal entry. These entries record the transaction’s effect on the accounting question in the accounting system.

Formatting When Recording Journal Entries

Double-entry bookkeeping is not a guarantee that no errors have been made—for example, the wrong ledger account may have been debited or credited, or the entries completely reversed. Once entered in the journal, the transactions may be posted to the appropriate T-accounts of the general ledger. Unlike the journal entry, the posting to the general ledger is a purely mechanical process – the account and debit/credit decisions already have been made. These accounts are further classified into various accounts of their type. This posting is the third step of the accounting cycle which is done following the double-entry bookkeeping.

When the supplies are delivered, she also receives invoice number 4987 from OfficeMart. Paid $500 to suppliers for partspurchased earlier in the month. In practice, the date of each transaction could also be included here. For illustration purposes, this extra information is not necessary. Learn more about how Pressbooks supports open publishing practices.

What Is a Journal Entry in Accounting?

As CEO and Co-Founder, Mike leads FloQast’s corporate vision, strategy and execution. Prior to founding FloQast, he managed the accounting team at Cornerstone OnDemand, a SaaS company in Los Angeles. He holds a Bachelor’s degree in Accounting from Syracuse University. Each of these journal entries would then be manually posted to the general ledger. If you’re thinking that sounds like a lot of work and a lot of opportunities for errors, you’re right. That’s where technology comes in to make our jobs easier.

- This is

posted to the Service Revenue T-account on the credit side. - The record is placed on the credit side of

the Accounts Receivable T-account across from the January 10

record. - This leaves and audit trail to follow back all of the entries in the ledgers back to the original entries in the journal.

- For convenience, include the year and month only at the top of each page and next to each month’s first entry.

- In practice, account numbers or codes may be included in the journal entries to allow each account to be positively identified with no confusion between similar accounts.

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate. Payment is received through cheque and a discount is allowed.

The double-entry bookkeeping helps to account for all the debits and credits by posting two entries. Notice that the word “inventory” is physically on the left of the journal entry and the words “accounts payable” are indented to the right. This positioning clearly shows which account is debited and which is credited. The process of transferring recorded business occurrences from the journal entry to the ledger is known as posting journal entries.

The journal states the date of a transaction, which accounts were affected, and the dollar amounts, usually in a double-entry bookkeeping method. When certain transactions of the same nature happen on the same date, it is preferred to pass a single journal entry instead of passing two or more entries. You’ve identified the accounts that will be involved in your journal entry, as well as the type of accounts they are. Debit your Expense account 1,500 to show an increase from the rent expense. But once you get the hang of it, recording journal entries will be less intimidating.

The process of exchanging recorded business occurrences from the general journal to the ledger is known as posting journal entries. In other words, following journalizing, posting is the next phase of the process. But with accounting software, transactions like those above are automatically entered in the correct accounts as invoices are created, customer payments are processed and bills are paid. This means that accountants today make comparatively few journal entries. Accounting software also makes it possible for small business owners to do their own bookkeeping.