Trade on Exness – What you need to understand when trading

Exness is one of the most trusted and prominent exchanges in the world, with more than 10 years of experience. Exness supplies its customers a wide range of accounts, items, and trading tools to match every requirement and degree of experience. To trade on Exness, you require to understand how to put orders, crucial notes, and frequently asked questions concerning this exchange. Allow ex-spouse Trading overview you all about trading on Exness.

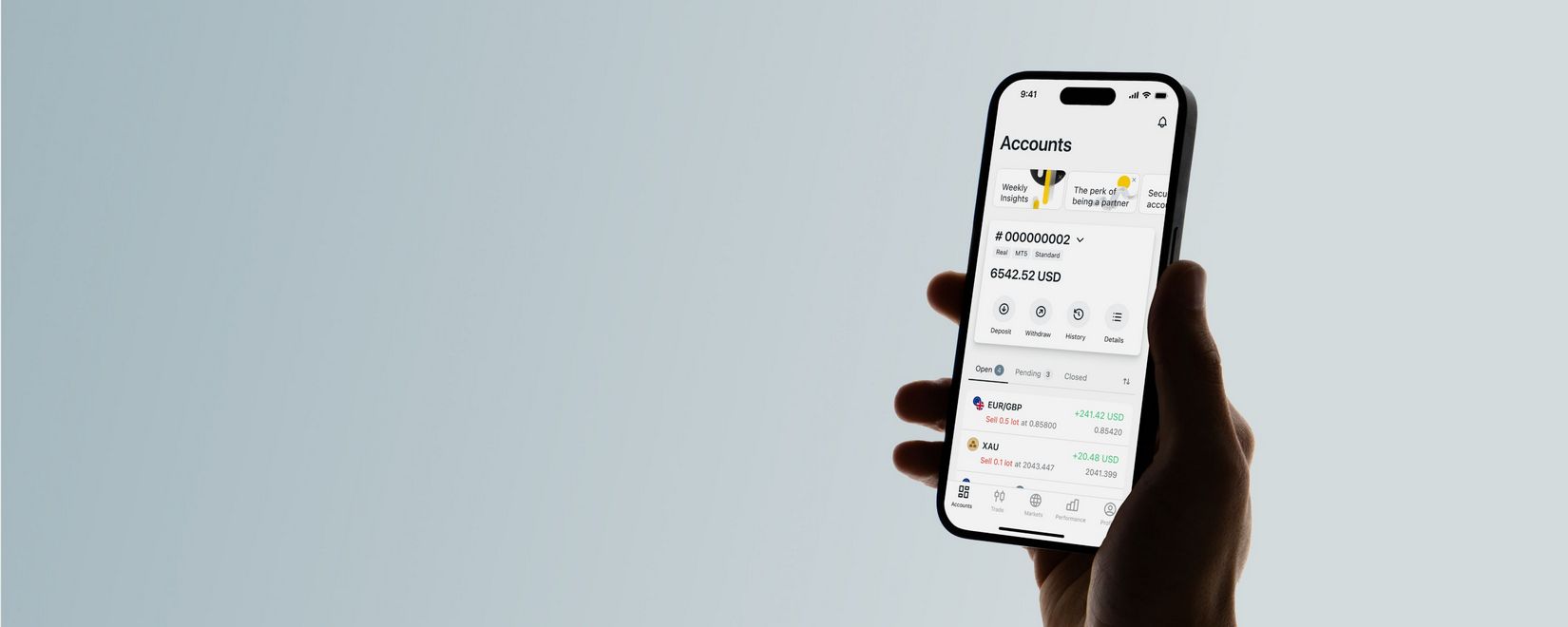

Instructions for trading Exness from A to Z

Below is one of the most detailed Exness trading guide

Transaction elements

To trade Exness on a computer or phone, investors require to download and install and set up MetaTrader 4 (MT4) or MetaTrader 5 (MT5) software on the device. Financiers can download this software program from the Exness site or from other sources. After installation is complete, open the software and visit with your Exness account.More Here Exness Demo Account At our site Below, investors will certainly see a main user interface with the following tools and features:

- Cost table: Shows the rate graph of the financial items you wish to trade. You can select chart type (candle light, line, bar), amount of time (from 1 minute to 1 month), and technological signs (trend, oscillator, volume) for technical evaluation.

- Trading table: Screens trading orders that you have actually opened up or placed. You can view in-depth details concerning trading orders, such as order kind (buy/sell), quantity, open rate, present rate, profit, and extra. You can additionally shut or change trading orders here.

- Dashboard: Shows controls for you to carry out trading activities, such as opening up brand-new orders, putting pending orders, placing a stop loss, taking earnings, routing quit, and much more.

- Category table: Displays a list of monetary products that you can trade on Exness. You can pick the economic product you wish to trade by clicking its name. You can additionally watch details concerning bid/ask costs, spreads, utilize, and extra.

Listing of items

- Technical evaluation and recognition of patterns, support, resistance levels, and entry/exit factors of that economic item making use of price graphes and technical signs.

- Establish departure conditions for your trade, such as stop loss, take revenue, and trailing quit. You can do this by getting in the wanted cost in the matching boxes on the panel or dragging the sliders on the cost graph.

- Click the alright button to confirm and implement your trading order. You will see your order appear on the trading panel and rate graph.

- Monitor your trading orders and close or customize them if needed. You can do this by right-clicking on the trade order on the trading panel or cost chart and selecting Close Order or Modify Order.

Benefits of trading on Exness for capitalists

When you choose to trade on Exness, you will enjoy the following advantages:

- Profession on several terminals, such as MT4, MT5, Web Terminal or Exness Terminal

- Trade with the most secure and trustworthy costs in the sector

- Immediate withdrawal, 24/7. You do not need to await manual processing or rely on financial institution service hours.

- Compliant with the Payment Card Industry Information Safety Standard (PCI DSS) to guarantee your safety and security and privacy

- Order matching is rapid and trustworthy. You can use the complimentary VPS (Virtual Private Server) web server solution to keep a constant link to Exness servers

- Clear rate history. You can watch price change information by degree for your trading tools.

- An account that matches your trading strategy. You can choose between different account types, like Standard, Raw Spread, Zero, or Pro. They have different trading conditions, such as spreads, compensations, utilize, maximum number of orders, and offered trading instruments.

Notes when trading on Exness

Trading hours

One more crucial variable that you require to take notice of when trading on Exness is the trading timespan. Trading hours are the moment period during which you can buy or sell an asset on the exchange. Trading hours may differ depending on the asset kind and market.

For instance, currency pairs are traded 24/5, from Monday to Friday. Time zone is GMT +2 of Exness. Rare-earth elements and powers are traded from 01:05 to 23:55 on service days. Traders can trade from 01:05 to 23:00 on Friday.

Stock indices are traded according to the operating hours of the corresponding stock market. As an example, the SP 500 is traded from 01:05 to 23:15 on organization days. In between 01:05 and 22:00 on Friday. Supplies are traded according to the operating hours of the issuing business. For instance, Apple shares are traded from 16:35 to 23:00 GMT +2.

You can check out the trading hours of assets on Exness by checking out the main Exness internet site or mosting likely to the Specifications area in the MT4 or MT5 software program. You must choose a trading timespan that fits your method and schedule, so you can make use of the most effective trading opportunities.

Trade on Exness and things to keep in mind

Assets are permitted to be traded using Exness

Exness offers you a large selection of trading assets, including:

- Money sets: These are possessions represented by the currency exchange rate in between two different money. For example, EUR/USD is the exchange rate in between euros and United States bucks. You can patronize over 100 currency sets on Exness, consisting of significant, small, and exotic money pairs.

- Precious metals: These are assets stood for by the cost of rare-earth elements such as gold, silver, platinum or palladium. As an example, XAU/USD is the rate of one ounce of gold in US bucks. You can trade 8 types of precious metals on Exness.

- Powers: These are possessions represented by the rate of power sources such as crude oil, natural gas, or fuel. For instance, UKOIL is the rate of a barrel of Brent oil in United States dollars. You can trade with 6 kinds of energies on Exness.

- Supply indices: These are properties represented by the worth of a group of supplies. This index typically stands for a particular market or market.

From the details pertaining to Trade on Exness over. Ideally, this short article has brought you valuable information when buying and selling at Exness. Wanting you effective trading and weart forget to adhere to EX Trading to upgrade the latest information about the exchange!

FAQ

In this section, I will respond to some frequently asked questions regarding trading on Exness, so you can much better understand this exchange and exactly how it trades.

Just how to open up an account to trade Exness?

To open an account on Exness, you need to check out the main Exness internet site and click the Register button. You will certainly be rerouted to a new web page, asking you to enter your email and password. When gotten in, you will certainly obtain a verification email from Exness, asking you to trigger your account. You require to click the link in the email to finish the registration procedure.

After triggering your account, you will certainly be redirected to your account monitoring page. This is where you can choose your account type, deposit money, take out cash, verify your identification, hellip;

How to transfer money into your account to trade Exness?

To deposit money right into your account on Exness, you need to log in to your account management page. Then click the Down payment button. You will certainly be rerouted to a brand-new web page. Below, Exness allows you to choose the payment method, quantity, and purchase money. You can pick between various repayment techniques. Choices include charge card, e-wallets, cryptocurrencies, or financial institution transfers.

After picking your payment method, you will be redirected to a new page asking you to go into the required info to finish the purchase. You require to go into the proper details and adhere to the instructions of the settlement approach you have actually picked. After completing the deal, the amount will be credited to your account within a couple of mins or hours, relying on the settlement technique.